seattle payroll tax lawsuit

The payroll tax rates range from 07 percent to 24 percent and apply only to salaries for employees making more than 150000 annually. Seattle Chamber Files Lawsuit Challenging Payroll Tax.

Judge Tosses Challenge To Seattle S Tax On Big Businesses Oregonlive Com

Today the Seattle Metropolitan Chamber of Commerce filed a.

. The Seattle City Council voted 7-2 to approve the tax. SEATTLE Today the Seattle Metropolitan Chamber of Commerce filed a lawsuit against the Seattle City Councils recently. A Washington Court of Appeals upheld the King County Superior Courts dismissal of a lawsuit brought by the Greater Seattle of Chamber of Commerce that contested the.

Seattle Mayor Jenny Durkan talks about coronavirus vaccine distribution a Seattle Metropolitan Chamber of Commerce lawsuit over the citys payroll tax and w. Chamber Files Lawsuit Against Seattle Payroll Tax. The objective of the tax was to have large.

The lawsuit alleges that the City Council imposed a tax on the right to earn a living BY. Published Tuesday December 8 2020 608 pm. In July of 2020 the Seattle City Council approved a payroll expense tax on businesses in Seattle with annual payrolls in excess of 7 million.

Published Tuesday December 8 2020 603 pm. SEATTLE A King County Superior Court judge has dismissed a lawsuit challenging a payroll tax passed last year by the Seattle City. King County Superior Court Judge Mary Roberts heard oral arguments Friday in a lawsuit filed against the city of Seattle over its JumpStart payroll tax on high salaries at big.

The tax rate ranges between 7 and 24 and is based on both the annual compensation paid to each employee and the total Seattle payroll expense of the business. The Seattle Metropolitan Chamber of Commerce filed a suit in late 2020 challenging the payroll taxs legality claiming. The Center Square Nearly 80 million from Seattles JumpStart payroll tax will go towards the construction of over 1700 affordable housing units in the city this year.

951 PM PDT June 4 2021. The highest end of the tax. Under the tax businesses with at least 7 million in annual payroll will be taxed at rates of between 07 to 24 on salaries and wages paid to Seattle employees who make at.

Councilmember Teresa Mosqueda Facebook

News Seattle Metropolitan Chamber Of Commerce

The Seattle Payroll Expense Tax What You Need To Know Clark Nuber Ps

Court Rules Seattle Payroll Expense Tax Is Constitutional

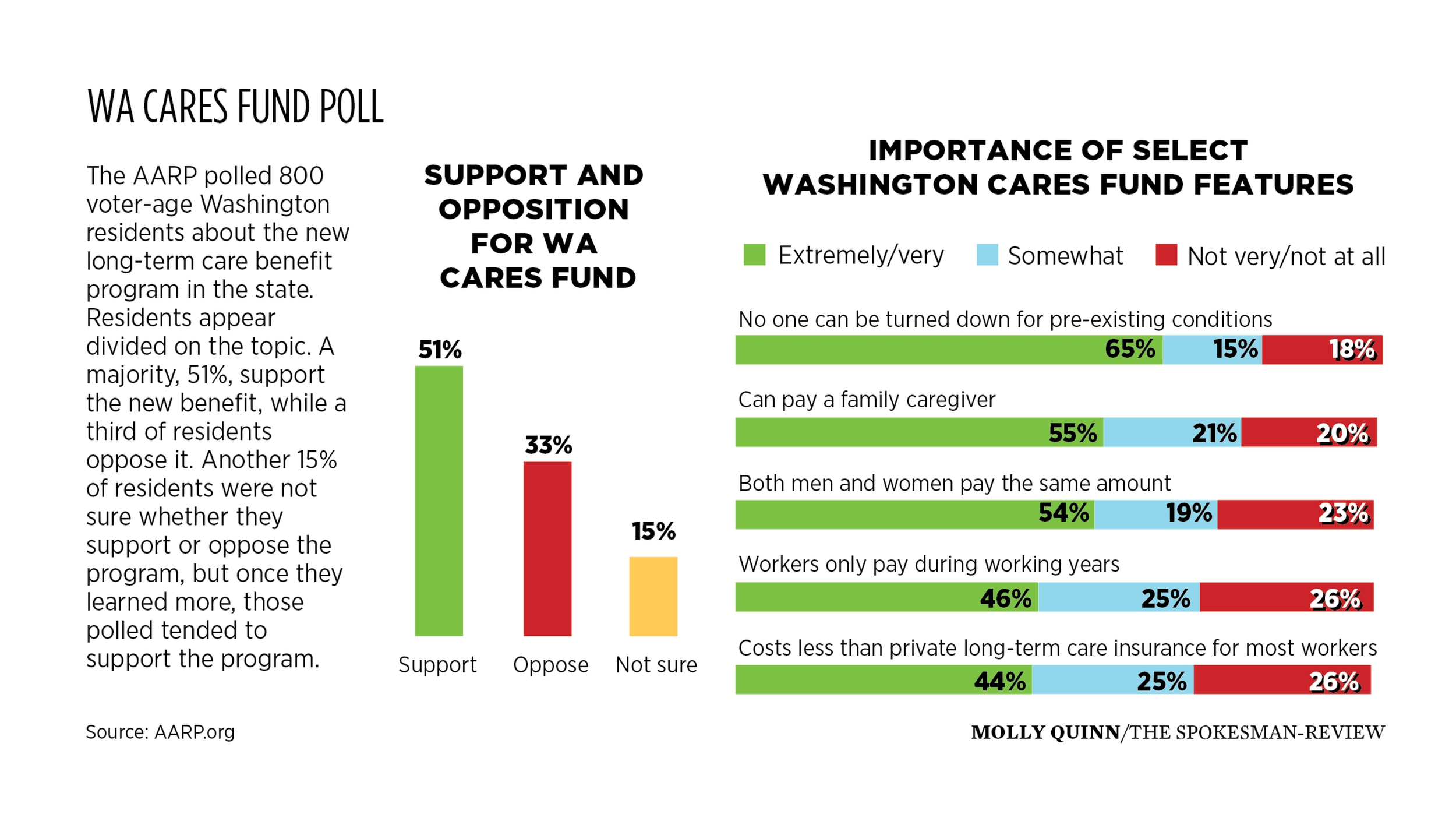

As Opposition Grows Washington S Long Term Care Tax To See Fixes In Legislature This Session The Spokesman Review

Seattle Just Passed A New Tax On Jobs In The Middle Of An Economic Crisis With One Infuriating Exception Foundation For Economic Education

Washington State Retools First In Nation Long Term Care Benefit Shots Health News Npr

Chamber Of Commerce Sues City Of Seattle For Imposing Tax On The Right To Earn A Living

Seattle S Pandemic Era Jumpstart Tax Brings In 231 Million King5 Com

As Opposition Grows Washington S Long Term Care Tax To See Fixes In Legislature This Session The Spokesman Review

How Seattle S New Payroll Tax Complicates Efforts To Enact One Statewide Crosscut

With Seattle S New Payroll Tax In Effect Businesses Are Sorting Through The Rules Puget Sound Business Journal

Wa Court Upholds Seattle S Jumpstart Payroll Tax Seattle Wa Patch

Seattle Chamber Sues Over City S New Jumpstart Payroll Tax On Big Businesses The Seattle Times

Seattle Income Tax Upheld In Court Bellevue Chamber

Chamber Of Commerce Renews Push To Overturn Seattle Big Business Tax Mynorthwest Com

Seattle King County Realtors New Seattle Payroll Expense Tax Includes Real Estate Brokerage Firms

Gov Inslee State Lawmakers In Talks About Delaying Washington S New Payroll Tax Set To Start In 2022

Amazon Tax Should Big Tech Pay For Problems It Magnified Protocol